The digital transformation of banking and finance is in full swing, with application programming interfaces (APIs) at the helm. APIs accelerate innovation by bridging financial institutions with third-party developers and fintech companies. By providing secure access to financial data and services, APIs enable the creation of personalised, integrated financial experiences. Open banking powered by APIs has already given rise to digital-first neo-banks, robo-advisors, peer-to-peer lenders, cross-border payment services, and much more. Traditional banks also continue…

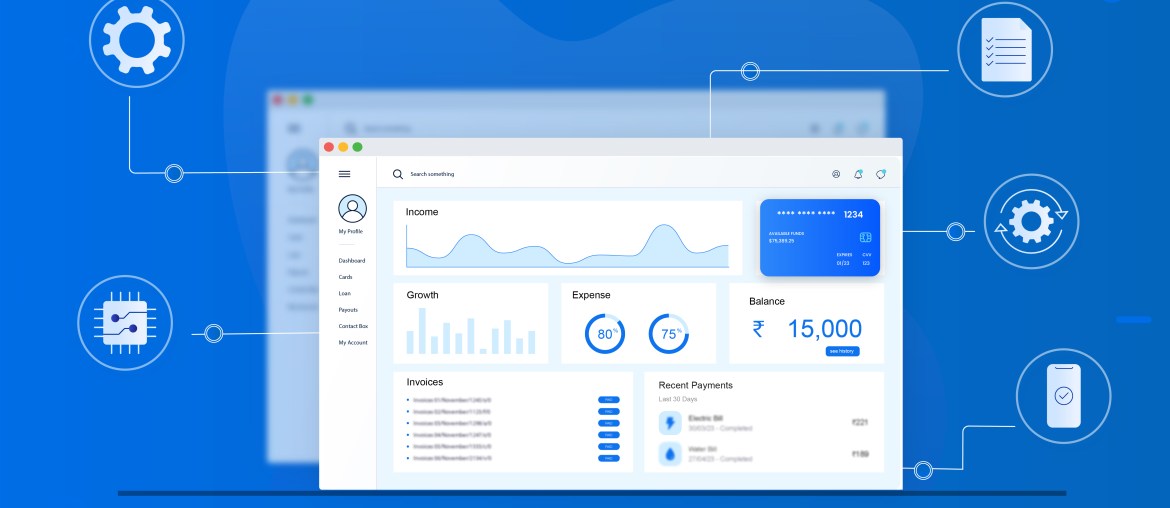

One key aspect that can significantly impact your company’s success is effective expense management. Modern expense management solutions are revolutionizing how businesses handle their finances, boosting efficiency and driving growth. With the seamless integration of cutting-edge technology and user-friendly interfaces, these innovative tools empower organizations to transform their financial processes, gain real-time insights, and make data-driven decisions. This article will explore how adopting these modern expense management solutions can help your business thrive, streamline operations,…

Unlocking growth potential through Fintech innovations is not just a buzzword; it’s a game-changing reality reshaping how businesses access working capital loans. As traditional banking methods struggle to keep up with the evolving demands of modern enterprises, Fintech has stepped up to the plate, revolutionizing the small business lending landscape with cutting-edge technologies and customer-centric approaches. This digital disruption empowers businesses of all sizes to tap into their full potential by streamlining the loan application…

Gone are the days of fumbling through your wallet for cash or handing your credit card to a cashier. The era of contactless payments has arrived, offering a convenient and safe way to pay for your purchases. With just a wave of your smartphone or card, you can complete transactions in seconds without touching a keypad or exchanging physical currency. Whether you’re grabbing a cup of coffee, shopping for groceries, or dining out, contactless payments…

As a financial professional, I have seen the limitations of traditional banking firsthand. Despite the growth of financial institutions, there are still billions of people around the world who are unbanked or underbanked. This is where financial inclusion comes in: everyone should have access to financial services regardless of their income or location. In recent years, platform-based banking has emerged as a game-changer in the financial inclusion revolution. In this article, we will discuss how…

The fintech industry is rapidly changing, and the future of banking is becoming more and more digital. Banking as a Service (BaaS) is a new way of delivering banking services that are revolutionizing the banking industry and financial technology, and it has the potential to change how we interact with our finances drastically. BaaS offers banks, businesses, and consumers the opportunity to access various banking services through APIs, allowing for greater flexibility and control. This…